extended child tax credit calculator

Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6. Enter the number of qualifying dependents aged 5 or younger age as of December 31 2021 for Tax Year 2021 including dependents or children born during 2021.

Aca Penalty Calculator Health Insurance Coverage Full Time Equivalent Employment

The basics were quite straightforward.

. Claim the Tax Refund You Deserve. The maximum is 3000 for a single qualifying person or 6000 for two or more. Partial Expanded Child Tax Credit.

Unless it is extended. How many can I claim. Child tax credit.

Estimate your 2021 Child Tax Credit Monthly Payment. The funds are available for children from 6 to 17 years old and cost 41 per month. If you are paying for childcare during 2021 you will claim this as one credit on your 2021 tax return to be filed in 2022.

30003600 child tax credit. Use This Simple Tax Calculator To Find Out if You Qualify For This Tax Savings. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of.

You can calculate your credit here. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line.

The Child Tax Credit and the Additional Child Tax Credit are meant to help working parents with low to moderate incomes. The Child and Dependent Care Tax Credit is worth anywhere from 20 to 35 of qualifying care expenses. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

Enter the number of qualifying dependents between the ages 6 and 17 age as of Dec. First its value was boosted to a 3000 maximum for children aged 6 to 17 and a 3600 maximum for children under the age of 6. The existing 2000 credit per child was raised to 3600 for children ages 5 and younger and to.

31 2021 for Tax Year 2021. Tax Changes and Key Amounts for the 2022 Tax Year. You will need to have certain information on hand before you begin working with the hmrc child credit calculator but once you begin it is fairly easy and only takes ten or fifteen minutes to.

Your amount changes based on the age of your children. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. How to Claim the Dependent Child Care Tax Credit.

Parents income matters too. Get your advance payments total and number of qualifying children in your online account. Your Adjusted Gross Income AGI determines how much you can claim back.

Child Tax Credit amounts will be different for each family. Earned income can come from salaries and wages self-employment and some disability payments. Here is some important information to understand about this years Child Tax Credit.

What made the original expanded Child Tax Credit special. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Congress fails to renew the advance Child Tax Credit.

The 2020 Child And Dependent Care Tax Credit. Enter your information on Schedule 8812 Form 1040. To reconcile advance payments on your 2021 return.

If your MAGI is 150000 or under you will receive 3600 per child under 6 and 3000 per child age 6-17. The Child Tax Credit provides money to support American families. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

Parents with higher incomes also have two phase-out schemes to worry about for 2021. Enhanced credit could be extended through 2025. Tax credits calculator - GOVUK.

The payment for children. Last year the Child Tax Credit got a number of key enhancements. Ad File to Get Your Child Tax Credits.

Max refund is guaranteed and 100 accurate. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Included in President Joe Bidens American Rescue Plan the 19tn coronavirus relief package is an extended child tax credit for.

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Your amount changes based on your income. Free means free and IRS e-file is included. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

If your MAGI is over 75000 the credit is phased. The first one applies to the extra credit amount added to. There are also maximum amounts you must consider.

Its a much bigger credit for potential taxpayers in tax year 2021. A childs age determines the amount. The credit will be fully refundable.

For that reason families must have a minimum of 2500 of earned income to claim the ACTC. Distributing families eligible credit through monthly checks for.

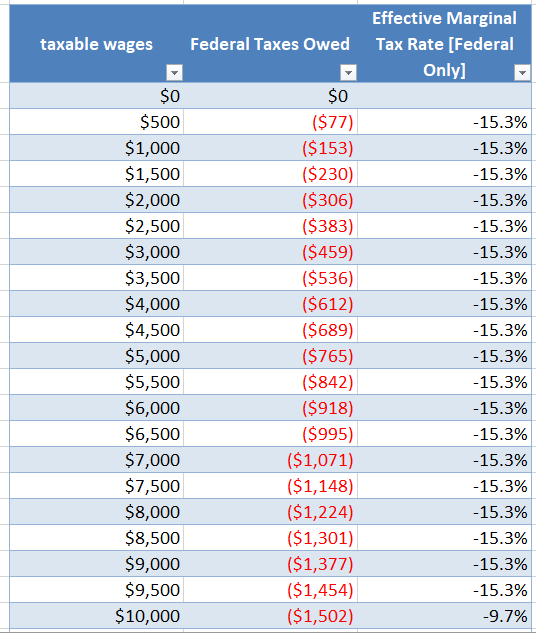

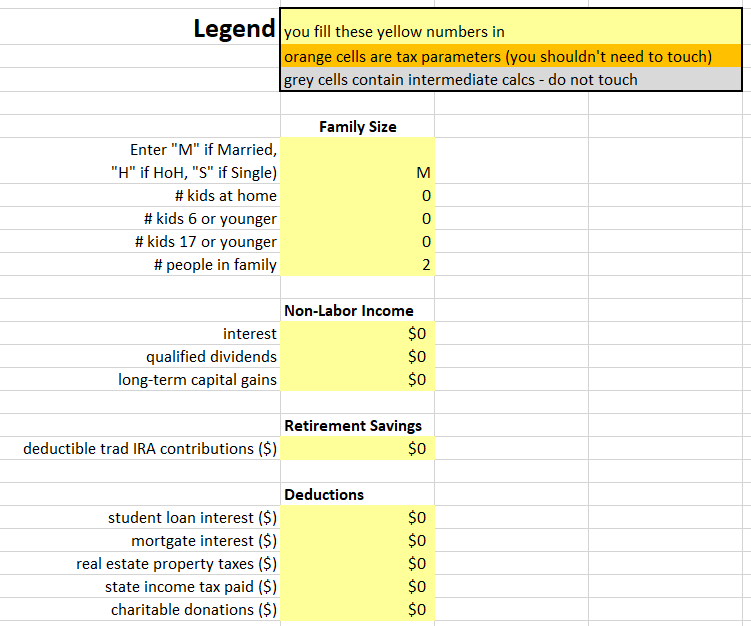

2021 Tax Calculator Frugal Professor

Try The Child Tax Credit Calculator For 2021 2022

2021 Tax Calculator Frugal Professor

5 Income Tax Tips For Notaries And Signing Agents Tax Deductions Irs Taxes Tax Questions

Income Tax Calculator Estimate Your Refund In Seconds For Free

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

How To Calculate Taxable Income H R Block

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Top Tax Refund Calculators In 2022 To Estimate Irs Payments With New Child Tax Credit

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Reduced Usage Of High Cost Financial Services The Source Washington University In St Louis

September Child Tax Credit Payment How Much Should Your Family Get Cnet

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out